Quoted from: https://www.gov.uk/government/publications/plastic-packaging-tax-amendments/plastic-packaging-tax-amendments

Published 27 October 2021

Who is likely to be affected

This measure will impact UK manufactures of plastic packaging and importers of plastic packaging.

General description of the measure

This measure introduces technical changes to Part 2, Schedule 9 and Schedule 13 of Finance Act 2021, concerning the Plastic Packaging Tax. These changes are to ensure that the legislation reflects the policy intent regarding the design and administration of the tax.

Policy objective

The measure ensures that the Plastic Packaging Tax operates as intended on commencement on 1 April 2022. It also ensures that the UK complies with international agreements and HMRC has the appropriate framework to administer the tax.

Background to the measure

Following a call for evidence in March 2018, the government announced at Budget 2018 a new tax on plastic packaging with less than 30% recycled plastic. The government launched a consultation in February 2019 seeking input on the initial proposals for the design of the tax. A summary of responses was published in July 2019.

At Budget 2020, the government announced key decisions on the design of the tax, and HMRC launched a consultation on the more detailed design and implementation of the tax.

In November 2020, the government published the draft primary legislation for technical consultation, alongside a summary of responses for the consultation held earlier in 2020. Feedback from the technical consultation was used to refine the draft primary legislation.

Primary legislation, which this measure amends, is included within Finance Act 2021. A Tax Information and Impact Note for the introduction of Plastic Packaging Tax was published on 20 July 2021 to accompany draft secondary legislation. It is available here.

Detailed proposal

Operative date

This measure will have effect on and after 1 April 2022, which is the date Plastic Packaging Tax commences.

Current law

Current law for Plastic Packaging Tax is contained within sections 42 to 85 and Schedules 9 to 15 of Finance Act 2021. This measure will amend sections 43, 50, 55, 63, 71, 84 and Schedules 9 and 13 of that Act.

Proposed revisions

Legislation will be introduced in Finance Bill 2021-22 to amend the Finance Act 2021. The amendments will:

• Allow HMRC to make provision to modify the timing of an import, and the meaning of import and customs formalities, using secondary legislation. This change ensures that the timing of imports can be amended to conform with changes to other policies, such as customs and Freeports (section 50)

• Ensure businesses below the de minimis threshold, who currently do not have a liability to register, do not have to pay the tax. This change ensures that the policy intent is achieved and reduces the burden of the tax on those businesses who manufacture and/or import plastic packaging below the de minimis threshold (section 52)

• Provide tax reliefs for persons enjoying certain immunities and privileges, such as visiting forces and diplomats, with provision to set administrative requirements in secondary legislation. This will ensure compliance with international tax agreements (section 55)

• Transfers the obligations and entitlements of Plastic Packaging Tax group members, such as completing returns, to the representative member of that group (section 71)

• Require HMRC to notify the representative member of a Plastic Packaging Tax group of the date that applications for and modification of group treatment will take effect. This change means that group registration can take effect from the date of the application, aligning with the timing of registration for the tax (Schedule 13)

• Change certain terms used to describe unincorporated bodies to ensure consistency throughout the legislation (Schedule 9)

Summary of impacts

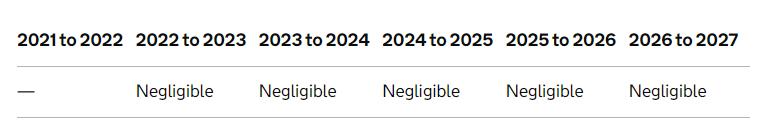

Exchequer impact (£m)

This measure is expected to have a negligible impact on the Exchequer.

Economic impact

This measure is not expected to have any significant economic impacts.

The Plastic Packaging Tax will provide a clear economic incentive for businesses to use recycled plastic material in plastic packaging, which will create greater demand for this material and in turn stimulate increased levels of recycling and collection of plastic waste, diverting it away from landfill or incineration.

The terms used in this section are defined in line with the Office for Budget Responsibility’s indirect effects process. This will apply where, for example, a measure affects inflation or growth. You can request further details regarding this measure at the email address listed below.

Impact on individuals, households and families

This measure is not expected to have an impact on individuals as it is designed to ensure that Plastic Packing Tax operates as originally intended. Individuals will not need to do anything differently as a result of these changes. This measure is not expected to impact on family formation, stability or breakdown.

Equalities impacts

It is not anticipated that this measure will impact on groups sharing protected characteristics.

Impact on business including civil society organisations

This measure is not expected to have an impact on businesses or civil society organisations as it is designed to ensure that Plastic Packing Tax operates as originally intended. Businesses or civil society organisations will not need to do anything differently compared to what they do now.

Operational impact (£m) (HMRC or other)

The changes introduced by this measure will not impact the costs previously outlined.

Other impacts

The changes made by this measure do not change the Justice Impact Test previously completed.

The rationale of this tax aims to increase the use of recycled plastic in plastic packaging, and it is estimated that as a result of the tax the use of recycled plastic in packaging could increase by around 40%. This is equal to carbon savings of nearly 200,000 tonnes in 2022 to 2023, based on current carbon factors.

Estimates of behaviour change have been noted as including a high degree of uncertainty by the Office for Budget Responsibility. The policy may also help to divert plastics from landfill or incineration, and drive recycling technologies within the UK.

Other impacts have been considered and none have been identified.

Monitoring and evaluation

The measure will be kept under review through communication with affected taxpayer groups.

Further advice

Zhiben, committed to realize the sustainable development of human and nature by the beauty of industrial civilization, provide you one-stop solution for eco packages.

For more detailed FAQ files please download from https://www.zhibenep.com/download

Post time: Oct-27-2021